Applied Analytics for Markets and Capital

Deusharvest is an analytical platform focused on markets, data, and decision-making under uncertainty.

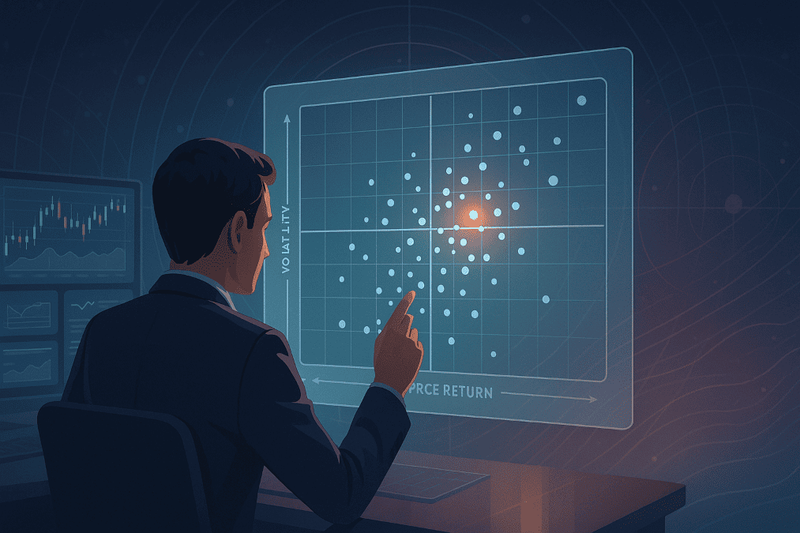

Market Structure & Price Behaviour

Analyzing the mechanics of price discovery and the structural dynamics that govern market movement.

Automation & Data Infrastructure

Architecting resilient data pipelines to extract, transform, and load high-frequency market data.

Data-Driven Decision Systems

Building robust frameworks that systematically translate raw data into actionable execution signals.

Recent Insights & Analysis

Latest analysis, strategies, and market perspectives.

Our Framework

A disciplined, four-stage analytical method applied across markets and complex systems to navigate uncertainty.

Define.

Deconstruct price action into its fundamental parts. Isolate variables to define the problem from first principles.

Extrapolate.

Conduct exploratory data analysis. Uncover correlations and project probabilities through historical testing.

Utilize.

Execute on the identified edge. Deploy capital efficiently once structural advantage is confirmed.

Sustain.

Ensure longevity. Continuously monitor system health and adapt to changing market regimes.