Relative Strength Index (RSI)

The Relative Strength Index (RSI), developed by J. Welles Wilder Jr., is a versatile momentum oscillator that measures the speed and magnitude of recent price changes. It does this by comparing the average size of upward price moves to the average size of downward price moves over a specified period. The resulting value oscillates between 0 and 100, and is primarily used to identify overbought (typically above 70) and oversold (typically below 30) conditions in the market, which can signal potential price reversals.

Function Syntax

=RSI(data, period) data(array):

Range of columns containing the date, Open, high, Low, close, volume data.period(number):

Number of periods (days) over which the RSI is calculated

Returns:

A two-column array of dates and their corresponding RSI values.

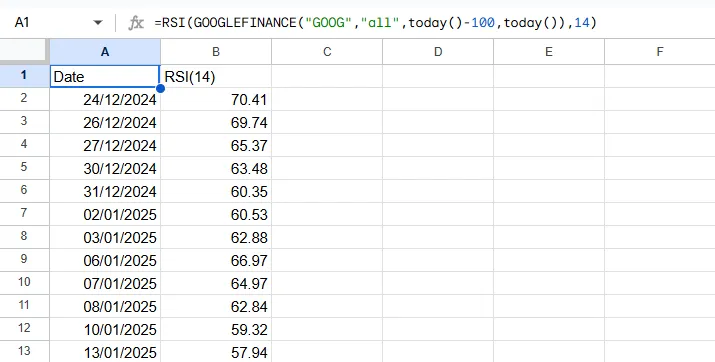

Output Example

Below is an example of the resulting array when applying the custom =RSI() function.